Welcome to today’s dive into Invitae, one of the more exciting companies in the genomics and genomic testing space. Invitae particularly gained widespread attention when Cathie Wood, CEO of ARK Invest mentioned on TV that the company was the most underappreciated stock in their portfolio. I hope this article gives you an idea of why she thought so.

I will be doing further dives into companies that are not widely discussed/under the radar. If you want access to content like this, make sure you subscribe so you don’t miss any release.

DISCLAIMER: I am not an Investment Advisor. The information provided in this article is not investment advice and should not be taken as one. Only use for educational purposes. Please do your own DUE DILIGENCE before making any investment decision.

Content

Overview of Invitae

Latest Business Metrics

Financials

Key 2021 Developments

Share Ownership

Optionality

Bull Case

Bear Case

Conclusion

1. Overview of Invitae

Invitae is a global genomics company whose mission is to bring comprehensive genetic information into mainstream medical practice to improve the quality of healthcare for billions of people.

The company believes its own TAM is $154B across different areas of genomics, genetic testing, healthcare and medicine.

It’s mission statement: To bring genetics to mainstream medicine to improve healthcare for billions.

For Invitae, genetic testing is only a starting point. The company has developed expertise in clinical interpretation of genetic results to medically actionable results. This is enabled by its CROP Platform (Clinical Report Optimization Platform).

According to the company, CROP is an environment that allows for the collaboration on variant interpretation and report writing. This allows Invitae to capture and aggregate learnings about variants, genes, diseases and conditions. It allows for the remembrance of what has been seen before and efficient reuse of information of what has been understood.

Invitae believes in putting information in the hands of patients. So Invitae developed a database (CLinvitae) on which variants interpretations are uploaded and available freely to patients and physicians.

In the production of its assays, the company has recruited an army of software engineers and geneticists to drive rapid automation in the production of its assays.

According to the company, its diagnostic capabilities range from oncology to reproductive health, liquid biopsy and exome sequencing. More specifically, its test catalogue spans a range of medical specialties such as:

Cardiology

Dermatology

Developmental Disorders (Cytogenetics)

Endocrinology

Exome Sequencing

Hematology

Hereditary Cancer

Immunology

Metabolic Disorders and Newborn Screening

Nephrology

Neurology

Ophtamology

Pediatric Genetics

Carrier Screening

Non-Invasive Prenatal Screening

Pregnancy Loss and Infertility

Pre-implantation Genetic Testing

Pre-natal Diagnosis

More information about a breakdown of these tests can been on the company’s website. Hint: There are at least 87 type of tests I counted, which would have made this article cumbersome.

Now that we know what the business is about (more good stuff below), let’s check on the state of the business.

2. Latest Business Metrics

More than 2 million patients served. Up 100% from 2 years ago.

Geographic and platform scale with Archer DX and Invitae. Present in 95+ countries, as at 2020.

In June 2020, Invitae had partnerships with over 90 biopharma companies. Signed 25+ biopharma partnerships in Q1 2021. Another 43 in Q2 2021.

YoY Billable volume grew 154% from 130000 in Q2 2020 to 287000 in Q2 2021. International volume constituted 19% of total billable volume.

Platform revenues seems to be reaching an inflection point, which I guess is a high margin business (margins on platform revenue is not presently broken down).

3. Financials

Latest ER signals an inflection point for revenue acceleration in coming years. Q2 2021 revenue grew 151% to $116M up from $46.2M Q2 2020. The company is presently not profitable.

Cash burn has been high over the years. In Q2 2021, it was $256.8M. Excluding acquisition expense, cash burn was $136.7M.

GAAP GM of 22%. Non-GAAP GM of 35%. Management targets over 50% gross margins in the long term. Slide deck from June 2020.

Guided up 2021 revenue projections to $475M-500M (taking COVID-19 into consideration) from $450M. At mid-point, 2021 revenues represent 0.3% of TAM.

Revenue growth is likely to remain elevated over the next couple of years, above peers.

4. Share ownership

Ark Invest owns 10.71% of the company (Bloomberg). In total, Institutions hold 87.38% of shares (NASDAQ). Insiders own 1.1% of shares (Finviz). Company is founder led. Sean George and Alex Furman are co-founders and still with the company. Although, they don’t seem to own many shares.

5. Optionality

Another potential source of revenue or a spinout company is Org1, Invitae’s People Analytics platform. The proprietary talent management platform was developed by Alex Furman (Invitae’s Co-Founder) with the idea that the way people are evaluated and promoted should be based on data-informed decision making.

Recently, Invitae sought to employ a Product Leader for Org1, who will work with Alex Furman. Job description is really telling and signals the start of a potential new business:

“You will take point on our effort to build the workplace of the future by transforming a robust internal tool with multiple early adopter clients into a business that makes organizations not only more effective but also more human.”

“The ideal candidate is passionate about using people analytics and state-of-the-art technology to empower individuals and teams, create and support cultures of transparency and mutual accountability, and building sustainable business operations that delight our customers, both internal and external. We’re looking for an empowered and entrepreneurially-minded leader to come in from the start of a new business.”

Simon Barnett also opined on Org1 saying,

“Yeah, another thought is that if this is very high-margin, then they can use the cashflow to lower the price point of another business line while maintaining platform-wide homeostasis.”

Alex Furman on Org1:

“Our in-house analytics system, Org1, allows us to measure things like perceived skill directly and continuously, ensuring that we identify problems as soon as they manifest. This is particularly exciting given that some of our growth happens by way of M&A, where we inherit whole teams.”

Safe to say, management has its hand in several buckets (as we will see below).

6. Key 2021 Developments

Partnership with Pacific Biosciences (Ticker Symbol: PACB) to reduce sequencing costs.

Appointed New CFO, Roxi Wen. Former CFO, Shelly Guyer will now focus on the company’s ESG efforts. I believe this will also ensure a smooth transition from the former CEO.

Opened early access to liquid biopsy-based personalised cancer monitoring as a central laboratory service.

New production plant in North Carolina, expanding into the East Coast- to go live Mid 2022. Will be employing over 350 people.

Joined NIH sponsored study to understand link between genes and cancer, heart disease and other conditions.

Received $1.2 Billion investment from Softbank.

Invitae expanded capabilities of its advanced clinical chatbot Gia that enable clinicians to use its advanced clinical chatbot Gia to guide their patients in an intuitive, enjoyable and telemedicine-friendly conversation through receiving and understanding genetic test results and possible next steps, including scheduling a call with a genetics counselor.

Added Medneon's risk assessment tools to its education and clinical support offerings. This additional capability supports clinicians and patients with cancer by making it easier to determine who should get testing and how to use genetic information to individualize treatment.

Genosity Acquisition for $200M which would help the global distribution of its Personalized Cancer Monitoring Platform (in development), reduce turnaround times and increase accessibility. Management commentary on Genosity in Q2 2021 earnings call:

“The acquisition of Genosity in Q2 has been one of our best moves from a strategic and integration execution standpoint. In a short time frame, the team has accelerated access to personalized oncology testing and monitoring, playing a key role in expanding up the LDT for MRD testing that Sean mentioned. This success has us super excited about delivering a level and range of prestigion care to patients that we believe is unparalleled.”

Other recent acquisitions include:

Diploid: has an AI software called MOON, which integrates an AI algorithm, a gene-disorder model and growing database to provide diagnosis in minutes.

Genelex and Youscript: provides pharmacogenetic information at point of care.

ArcherDX (Invitae biggest acquisition): allows Invitae to integrate germline and somatic testing, tumor profiling and more importantly, liquid biopsy capabilities into its platform.

Overall, these acquisitions has allowed the company to develop a “network approach”, different from a direct-to-consumer approach adopted by competitors. This approach also means Invitae has pricing power as it can aggressively drive costs lower to boost volume.

Are you getting the “Amazon of Genomics” vibe Cathie Wood painted in March?

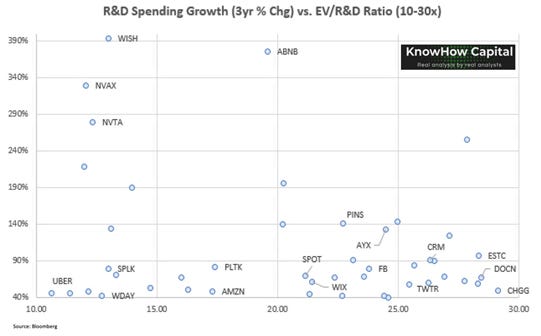

As seen in the below chart, R&D spend has been high, making up a huge proportion of its cash burn (spend). It’s fair to say the dilutions have provided cash to support its expansion.

7. Bull Case

Continued demand for its product/service offerings. Genomics is getting more mainstream. Question is, will people continue to seek information about their health moving forward? I think yes, and increasingly so.

Boosted cash position and a commitment to cost reduction going forward. This might signify less or no dilution. Fingers crossed.

Founder Led. Two visionary founders are still with the company.

Collaboration with Pacific Biosciences, which could help drive down sequencing costs, potentially driving higher billable volumes and increased access to global population.

Large scale of global operations, with burgeoning biopharma partnerships and diverse product/service offerings. Simon Barnett of ARK Invest breaks down the product/ service offerings:

Quality (Sherloc IP)

Comprehensiveness (Long-Reads, Proprietary Workflows, Integrated Multi-Omics); Distribution (B2B, DTC, Pharma, Payor)

Largest Biopharma Network and Patient Advocacy

Largest Publisher of Annotated Genetic Findings

Breadth of Content (Germline, Somatic, Reproductive, Rare Disease, Microbiome, etc.)

Medical Brand

Digital Infrastructure (Telemedicine Integration, Clinical Workflow Integration (Organic + Medneon + Genosity + Clear)

Breakthrough Products (AMP Chemistry, Fusion Detection, Degraded Tissue Expertise)

Vertical Integration (Full Stack, Including Probe Manufacture)

Low Cost Patient Pay Model

Massive/Global Scale

Data/platform access business

In-hospital device integration

HiFi sequencing platform/rare disease (business opportunity),

OUS business growth

Potential use of Omniome tech (of PACB) in liquid biopsy

8. Bear Case

Historically highly dilutive company: Share count has 4Xed over the past 4 years and 10Xed since IPO. In the past 5 years, Enterprise value has risen by over 2700%, while stock price has risen only 200%.

Company has been largely acquisitive, hence, there are integration risks.

Cash burn has also been historically high.

However, it appears the company aims to reduce this dilution, given the $1.2B cash infusion from Soft Bank. Invitae now has cash of $1.54B, as of Q2 2021. Also, management seems to be tracking towards reducing cash burn. The Chief Operating Officer in Q2 2021 Earnings Call said:

“And we expect that that investment is going to generate a sufficient amount of revenue into the future. And so the way we're looking at our investment portfolio as we think that as a percentage of sales, we probably hit the high point but we have an aggressive revenue expectation, again, 50% to 60% growth on an annual basis. And so we expect that the company will continue to grow. We will continue to invest in the business just not as a percentage of sales as we have done over the last couple of years.”

9. Conclusion

As at market close on 27th August 2021, Invitae’s market cap was $6.28B. Trading at a P/S of 16.14. Not cheap by traditional metrics although the company has a cash position of $1.54B and a revenue CAGR of 50-60% for the next 3-4 years. It’s still a relatively small company and has a huge runway ahead.

It’s already a market leader in the genomic testing space, but with so much more to offer in product/service offerings. However, it remains to be seen how management will manage costs going forward. If management continues to execute, I see the company’s market cap potentially exploding to the upside.

If you enjoyed reading this article, please kindly subscribe to the channel and/or follow on Twitter @InvestingPlug for more content like this. Also kindly share, comment and let’s learn together.

DISCLOSURE: I am long shares of Invitae (3.41% of PA) and Pacific Biosciences (13.35% of PA).

Sources of Information: Invitae website and Investor Deck, Seeking Alpha articles, Simon Barnett Twitter notes (@sbarnettARK), Chart from Knowhow Capital (CapitalKnowhow) and my Personal opinions.